UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________

SCHEDULE 14A

(Rule 14A-101)

INFORMATION REQUIRED IN PROXY STATEMENT

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No.)

Filed by the Registrant |

|

Filed by a Party other than the Registrant |

Check the appropriate box:

Preliminary Proxy Statement Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) Definitive Proxy Statement Definitive Additional Materials Soliciting Material Pursuant to §240.14a-12 |

|

|

|

|

|

|

|

|

|

LM FUNDING AMERICA, INC.

(Name of Registrant as Specified Inin Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

No fee required. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fee paid previously with preliminary materials.

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11

NOTICE OF ANNUAL MEETING

AND PROXY STATEMENT

2016

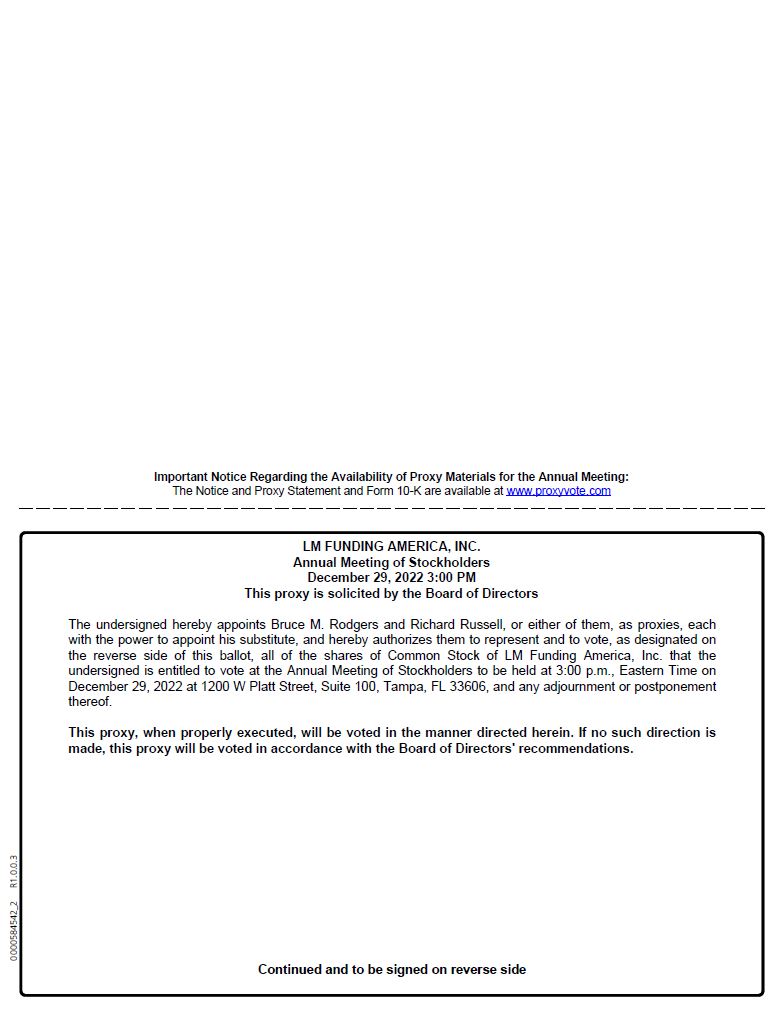

TO OUR SHAREHOLDERS:November 28, 2022

You are cordially invited to attend our 2016 Annual Shareholders’ Meeting of Stockholders, which will be held at Cinebistro at Hyde Park Village, 16091200 West Swann Avenue,Platt Street, Suite 100 Tampa, Florida 33606, on Thursday, June 16, 2016,December 29, 2022, at 33:00 p.m., local time. ShareholdersStockholders will be admitted beginning at 2:3045 p.m.

The attached notice of annual meetingAnnual Meeting of shareholdersStockholders and proxy statement cover the formal business of the annual meetingAnnual Meeting and contains a discussion of the matters to be voted upon at the annual meeting.Annual Meeting. At the annual meeting,Annual Meeting, our management will also provide a report on our operations and achievements during the past year.

Your vote is very important. Whether or not you plan to attend the meeting in person, please vote your shares by completing, signing and returning the accompanying proxy card, or by following the instructions on the card for voting by telephone or Internet.internet. If you later decide to attend the annual meetingAnnual Meeting and vote in person, you may revoke your proxy at that time.

Bruce M. Rodgers, Esq. |

| |

|

| |

Chairman of the Board Chief Executive Officer |

NOTICE OF ANNUAL MEETING OF SHAREHOLDERSSTOCKHOLDERS

TO THE SHAREHOLDERSSTOCKHOLDERS OF LM FUNDING AMERICA, INC.:

TIME: |

| |

|

| |

PLACE: |

Tampa, Florida 33606 | |

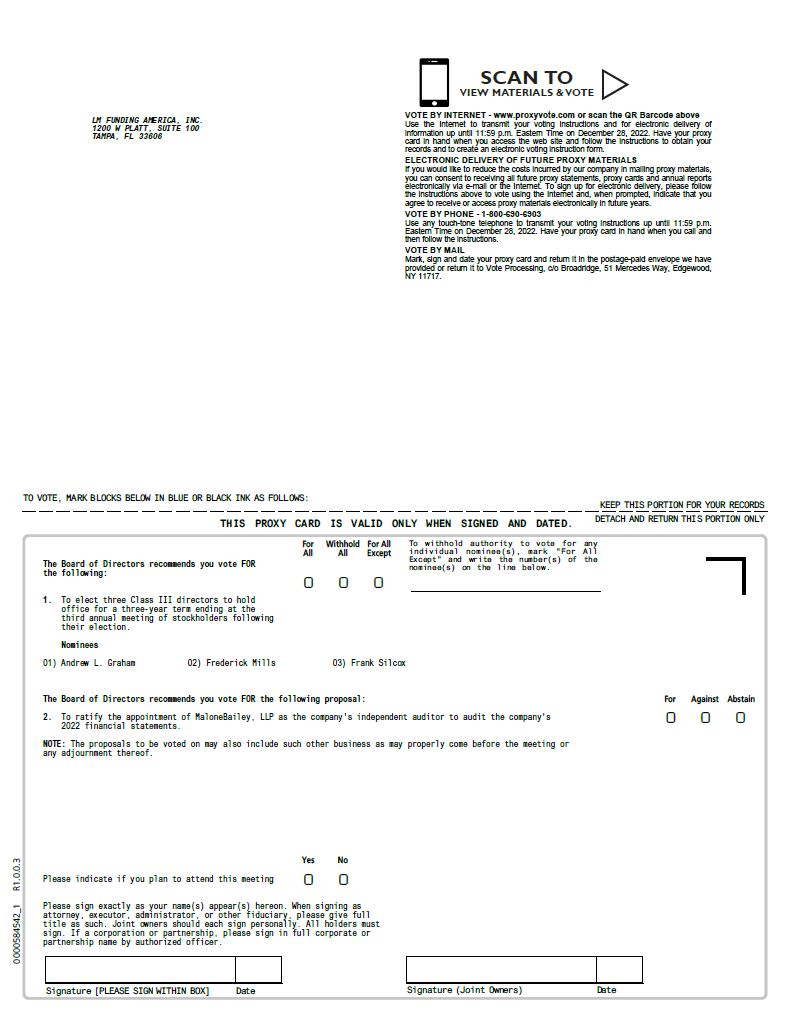

ITEMS OF BUSINESS: | 1. | To elect |

|

|

|

| 2. | To ratify the appointment of MaloneBailey, LLP as the company’s independent auditor to audit the company’s 2022 financial statements; and |

3. | To transact such other business that may properly come before the meeting or any adjournments or postponements thereof. | |

|

| |

RECORD DATE |

| |

|

| |

ANNUAL REPORT | Our | |

|

| |

It is important that your shares be represented at the | ||

By Order of the Board of Directors,

Bruce M. Rodgers

Chairman of the Board

Chief Executive Officer

Aaron L. Gordon, Esq.

General Counsel and Secretary

ANNUAL MEETING OF SHAREHOLDERSSTOCKHOLDERS

TO BE HELD ON JUNE 16, 2016DECEMBER 29, 2022

TO THE LM FUNDING AMERICA, INC.: |

|

|

This proxy statement and the form of proxy are delivered in connection with the solicitation by the Board of Directors of LM Funding America, Inc. (the “company,” “we,” “us,” or “us”“our”), a Delaware corporation, of proxies to be voted at our 2016below-described Annual Meeting of ShareholdersStockholders and at any adjournments or postponements thereof.

You are invited to attend our Annual Meeting of ShareholdersStockholders on Thursday, June 16, 2016,December 29, 2022, beginning at 3 p.m., local time.3:00 p.m.. The Annual Meeting will be held at Cinebistro at Hyde Park Village, 16091200 West Swann Avenue,Platt Street, Suite 100, Tampa, Florida 33606. ShareholdersStockholders will be admitted beginning at 2:3045 p.m.

Your vote is very important. Therefore, whether you plan to attend the Annual Meeting or not and regardless of the number of shares you own, please date, sign and return the enclosed proxy card promptly or follow the instructions on the card for voting by telephone or Internet.internet.

At the meeting, the use of cameras, audio or video recording equipment, communications devices or similar equipment will be prohibited.

Important Notice Regarding the Availability of Proxy Materials

for the Shareholder Meeting to be Held on June 16, 2016:December 29, 2022:

This proxy statement and the 20152021 Annual Report to ShareholdersStockholders, as amended, are available at www.proxyvote.comwww.proxydocs.com/LMFA.

Upon your written request, we will provide you with a copy of our 20152021 annual report on Form 10-K, as amended, including exhibits, free of charge. Send your request to LM Funding America, Inc., c/o Aaron Gordon, General Counsel and Secretary, 302 Knights Run Avenue, Attention:Bruce M. Rodgers, Chief Executive Officer, 1200 West Platt Street, Suite 1000,100, Tampa, Florida 33602.33606.

What is the purpose of the meeting?

The principal purposepurposes of the Annual Meeting isare to ratify the appointment of our outside auditors andelect twothree directors to the company’s Board of Directors. In addition, our management will report on our performance during 2015,2021, discuss challenges ahead and respond to questions from shareholders.stockholders.

When were these materials mailed?

We beganexpect to begin mailing this proxy statement on or about May 16, 2016.November 28, 2022.

Who is entitled to vote?

ShareholdersStockholders of record at the close of business on the record date, May 2, 2016,November 17, 2022, are entitled to vote in person or by proxy at the Annual Meeting. In general, shareholdersstockholders are entitled to one vote per share on each matter voted upon. In an election for directors, however, shareholdersstockholders are entitled to vote the number of shares they own for as many director candidates as there are directors to be elected. The Board of Directors has determined that the Board of Directors should include twothree Class IIII directorships. Accordingly, since twothree directors are to be elected at this Annual Meeting, in electing directors, each share will entitle the shareholderstockholder to twothree votes, one per director. ShareholdersStockholders may not cumulate their votes. As of April 29, 2016November 17, 2022, there were 3,300,00013,091,883 common shares outstanding.

What constitutes a quorum?

The presence at the Annual Meeting, in person or by proxy, of the holders of a majority33-1/3% of the shares outstanding will constitute a quorum, permitting us to conduct the business of the meeting.

What is the difference between a shareholder of record and a beneficial owner?

If your shares are registered directly in your name with our transfer agent, AmericanV Stock Transfer, & Trust Company, LLC, then you are a “shareholder of record.” This Notice of Meeting and proxy statement has been provided directly to you by LM Funding America, Inc. You may vote by ballot at the meeting or vote by proxy. To vote by proxy, sign, date and return the enclosed proxy card or follow the instructions on the proxy card for voting by telephone or Internet.internet.

If your shares are held for you in a brokerage, bank or other institutional account (that is, held in “street name”), then you are not a shareholder of record. Rather, the institution is the shareholder of record and you are the “beneficial owner” of the shares. The accompanying Notice of Meeting and this proxy statement have been forwarded to you by that institution. If you complete and properly sign the accompanying proxy card and return it in the enclosed envelope, or follow the instructions on the proxy card for voting by telephone or Internet,internet, the institution will cause your shares to be voted in accordance with your instructions. If you are a beneficial owner of shares and wish to vote in person at the Annual Meeting, then you must obtain a proxy, executed in your favor, from the holder of record (the institution).

How do I vote?

By Ballot at the Meeting. If you are a shareholder of record and attend the Annual Meeting, you may vote in person by ballot at the Annual Meeting. To vote by ballot, you must register and confirm your shareholder status at the meeting. If the shareholder of record is a corporation, partnership, limited liability company or other entity of which you are an officer or other authorized person, then you should bring evidence of your authority to vote the shares on behalf of the entity. If your shares are held for you in a brokerage, bank or other institutional account (that is, in “street name”), you must obtain a proxy, executed in your favor, from that institution (the holder of record) to vote your beneficially-owned shares by ballot at the Annual Meeting. In the election of directors (Matter(Proposal No. 1), each share held by a shareholder of record will be entitled to twothree votes, one for each director to be elected.

By Proxy. If you complete, sign and return the accompanying proxy card or follow the instructions on the proxy card for voting by telephone or Internet,internet, then your shares will be voted as you direct. In the election of directors (Matter(Proposal No. 1), your options with respect to each director are to direct a vote “FOR”, “WITHHOLD ALL”, or to “WITHHOLD AUTHORITY.” “FOR ALL EXCEPT”.

If you are a shareholder of record, then you may opt to deliver your completed proxy card in person at the Annual Meeting.

Can I vote by telephone or Internet?internet?

Yes. If you follow the instructions on the proxy card for voting by telephone or Internet,internet, your shares will be voted as you direct.

How Abstentions and Broker Non-Votes Are Treated

Abstentions will be counted as shares that are present for purposes of determining a quorum. For the election of directors, abstentions are excluded entirely from the vote and do not have any effect on the outcome. Broker non-votes occur when a broker or other nominee holding shares for a beneficial owner does not have discretionary voting power on a matter and has not received instructions from the beneficial owner. Broker non-votes are included in the determination of the number of shares represented at the Annual Meeting for purposes of determining whether a quorum is present. If you do not provide your broker or other nominee with instructions on how to vote your “street name” shares, your broker or nominee will not be permitted to vote them on nonroutine matters such as proposalProposal No. 1. Shares subject to a broker non-vote will not be considered entitled to vote with respect to proposalProposal No. 1 and will not affect the outcome of proposalProposal No. 1.

What does it mean if I receive more than one proxy card?

You will receive separate proxy cards when you own shares in different ways. For example, you may own shares individually, as a joint tenant, in an individual retirement account, in trust or in one or more brokerage accounts. You should complete, sign and return each proxy card you receive or follow the telephone or Internetinternet instructions on each card. The instructions on each proxy card may differ. Be sure to follow the instructions on each card.

Can I change my vote or instruction?

Yes. You may follow the instructions on the proxy card to change your votes or instructions any time before midnight the day before the meeting. In addition, if you are a shareholder of record, you may revoke your proxy any time before your shares are voted by filing with the secretary of the company a written notice of revocation or submitting a duly executed proxy bearing a later date. If you file a notice of revocation, you may then vote (or abstain from voting) your shares in person at the Annual Meeting. If you submit a later dated proxy, then your shares will be voted in accordance with that later dated proxy. No such notice of revocation or later dated proxy, however, will be effective unless received by us at or before the Annual Meeting and before your shares have been voted. Unless the proxy is revoked, the shares represented thereby will be voted at the Annual Meeting or any adjournment thereof as indicated on the proxy card. Sending in a proxy does not affect your right to vote in person if you attend the meeting, although attendance at the meeting will not by itself revoke a previously granted proxy.

If I submit a proxy card, how will my shares be voted?

Your shares will be voted as you instruct on the proxy card.

What happens if I submit a proxy card and do not give specific voting instructions?

If you are a shareholder of record and sign and return the proxy card without indicating your instructions, your shares will be voted in accordance with the recommendations of the Board of Directors. With respect to any other matter that properly comes before the meeting, the proxy holders will vote as recommended by the Board of Directors or, if no recommendation is given, inat their own discretion. As of the date this proxy statement went to print, we did not know of any other mattermatters to be raised at the Annual Meeting.

What are the Board’sBoard of Directors’ recommendations?

The Board of Directors recommends votes—votes:

|

| FOR election of the following nominees for director positions: |

Andrew L. Graham

Frederick Mills

Frank Silcox

➢ | FOR the proposal to ratify the appointment of MaloneBailey, LLP as the company’s independent auditor to audit the company’s 2022 financial statements; | |

➢ | FOR the authority to transact such other business as may properly come before the stockholders at the Annual Meeting. |

Mr. Bruce Martin Rodgers

Ms. Carollinn Gould

What vote is required to approve each item?

Election of directors. In the election of directors, the two highest recipients of “FOR” votes will be elected. A properly executed proxy card marked “WITHHOLD AUTHORITY” with respectThe vote required to the election of one or more director nominees will notapprove each matter to be voted with respect to the director or directors indicated, even though it will be counted for purposes of determining whether there is a quorum presenton at the Annual Meeting.

Other Matters.Meeting is described below. We do not anticipate other matters coming to a vote at the Annual Meeting. Should any other matter be brought to a vote, the matter will be approved by the affirmative vote of the majority of the outstanding shares present in person or by proxy at the Annual Meeting and entitled to vote on the subject matter at a meeting at which a quorum is present unless a greater number of affirmative votes is required for approval of that matter under our certificateCertificate of incorporation, by-laws,Incorporation, bylaws, or the Delaware General CorporateCorporation Law.

Under the Delaware General Corporation Law, an abstaining vote is considered present and entitled to vote and, therefore, is included for purposes of determining whether a quorum is present at the Annual Meeting. Pursuant to our bylaws, abstentions are not considered to be ‘‘votes cast’’ for the election of directors in Proposal No. 1 and will not affect the outcome of the election of directors. Abstentions are considered both present and “entitled to vote” on a matter. Accordingly, an abstention counts as a vote “against” any proposal where the voting standard is “a majority of the shares present and entitled to vote” or “a majority of the outstanding shares.”

A broker ‘‘non-vote’’ occurs when a nominee holding shares for a beneficial owner does not vote on a particular proposal because the nominee does not have discretionary voting power with respect to that item and has not received instructions from the beneficial owner. Under the Delaware General Corporation Law, a broker ‘‘non-vote’’ is not deemed to be a ‘‘vote cast’’ and, therefore, will not affect the outcome of the election of directors. While a broker ‘‘non-vote’’ is considered present for purposes of determining whether a quorum is present at the Annual Meeting, it is not considered ‘‘entitled to vote’’ and, therefore, not included in the tabulation of the voting results on matters requiring approval of the holders of a majority of the shares present in person or represented by proxy and entitled to vote. When the voting standard is approval of “a majority of the outstanding shares,” broker non-votes have the same effect as a vote “against” the proposal.

The required vote for each of the proposals expected to be acted upon at the Annual Meeting is summarized below:

Proposal No. 1 — Election of directors. Directors are elected by a plurality, with the three nominees obtaining the most votes being elected. Because there is no minimum vote required, abstentions and broker non-votes will be entirely excluded from the vote and will have no effect on its outcome. Under the plurality vote standard, any shares that are not voted, whether by abstention, broker non-votes or otherwise, will not affect the election of directors.

Proposal No. 2 — Ratification of independent registered public accounting firm. This proposal must be approved by the affirmative vote of the majority of shares present in person or represented by proxy at the Annual Meeting and entitled to vote, assuming a quorum is present. Abstentions count as a vote “against” the proposal and broker non-votes will be entirely excluded from the vote and will have no effect on its outcome.

How will votes be counted?

All votes will be tabulated by the secretary of the company. We have engaged Broadridge Financial Solutions, Inc. to collect and tabulate proxy instructions. Although abstentions and broker non-votes are each included in the determination of the number of shares present, they are not counted on any matters brought before the meeting.

Who is paying for the preparation and mailing of the proxy materials and how will solicitations be made?

We will pay the expenses of soliciting proxies. Proxies may be solicited on our behalf by directors, officers or employees in person or by mail, telephone, facsimile or electronic transmission. We have requested brokerage houses and other custodians,

nominees and fiduciaries to forward soliciting material to beneficial owners and have agreed to reimburse those institutions for their out-of-pocket expenses.

PROPOSAL 1

.

ELECTION OF DIRECTORS

TwoThree directors are to be elected at the Annual Meeting. In accordance with the company’s certificateCertificate of incorporation,Incorporation, the Board of Directors is divided into three classes. Class I and Class II each consists of two directors, withand Class III consistingconsists of three directors. All directors within a class have the same three-year terms of office. The class terms expire at successive annual meetings so that each year a class of directors is elected. The current terms of director classes are scheduled to expire at the annual meeting of stockholders in 20162023 (Class I directors), 20172024 (Class II directors), and 20182022 (Class III directors). Accordingly, the Class III directors will be elected at this Annual Meeting. Each of the Class IIII directors elected at the 2016this Annual Meeting will be elected to serve a three-year term.

With the recommendation of the Nominatingnominating and Governance Committee,governance committee, the Board of Directors has nominated the following persons to stand for election as Class IIII directors at the 2016this Annual Meeting of Shareholders,Stockholders, with terms expiring in 2019:at the third annual meeting of stockholders following their election:

Mr. Bruce Martin RodgersAndrew L. Graham

Ms. Carollinn GouldFrederick Mills

Frank Silcox

Each of the nominees for election as a director has consented to serve if elected. If, as a result of circumstances not now known or foreseen, one or more of the nominees should be unavailable or unwilling to serve as a director, proxies may be voted for the election of such other persons as the Board of Directors may select. The Board of Directors has no reason to believe that any of the nominees will be unable or unwilling to serve.

The persons named in the enclosed proxy card intend, unless otherwise directed, to vote such proxy “FOR” the election of Mr. Bruce M. RodgersAndrew L. Graham, Mr. Frederick Mills and Ms. Carollinn Gould,Mr. Frank Silcox as Class IIII directors of LM Funding America, Inc. The nominees receiving the twothree highest “FOR” vote totals will be elected as directors.

In the election of directors, the three highest recipients of “FOR” votes will be elected. A properly executed proxy card marked “WITHHOLD ALL" or “FOR ALL EXCEPT” with respect to the election of one or more director nominees will not be voted with respect to the director or directors indicated, even though it will be counted for purposes of determining whether there is a quorum present at the Annual Meeting.

RECOMMENDATION OF THE BOARD OF DIRECTORS

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR ELECTION OF EACH OF THE NOMINEES AS

DIRECTORS OF THE COMPANY —

ITEM 1 ON YOUR PROXY CARD.

DIRECTORS

Set forth below is a summary of the background and experience of each director nominee and director. There areis no family relationship among any of the directors and/or executive officers of the company except as follows: Mr. Bruce M. Rodgers, our Chairman, and Chief Executive Officer and President, and Ms. Carollinn Gould, our Vice President—General Manager, Secretary, and director, have been married since 2004 and2004.

Effective November 16, 2022, Mr. Joel E. Rodgers Sr. isresigned from his position as a member of our Board of Directors. Accordingly, the fatherBoard of Bruce M. Rodgers andDirectors appointed Mr. Tian “Todd” Zhang to our Board of Directors, effective November 16, 2022, to fill the father-in-lawvacancy created by the resignation of Carollinn Gould.Mr. Joel Rodgers. Mr. Zhang was appointed as a “Class II” director for a term that ends at the 2024 annual meeting of stockholders.

Directors Standing for Election (Class I)III)

Bruce M. Rodgers.Andrew L. Graham. Mr. Rodgers,Graham, age 52,64, has served as the Chairman of the Board of Directors and Chief Executive Officera director of the company since its initial public offering in October 2015. Since June 2008, Mr. Graham has served as Vice President, General Counsel and Secretary of HCI Group, Inc. (NYSE:HCI). From 1999 to 2007, Mr. Graham served in various capacities, including as General Counsel, for Trinsic, Inc. (previously named Z-Tel Technologies, Inc.), a publicly-held provider of communications services headquartered in Tampa, Florida. Since 2011, Mr. Graham has served on the Internal Audit Committee of Hillsborough County, Florida. From 2007 to 2011, he served on the Board of Trustees of Hillsborough Community College, a state institution serving over 45,000 students annually.

Mr. Graham holds a Bachelor of Science, major in Accounting, from Florida State University and a Juris Doctor, as well as a Master of Laws (L.L.M.) in Taxation, from the University of Florida College of Law. Mr. Graham was licensed in Florida as a Certified Public Accountant from 1982 to 2001. As a Certified Public Accountant, he audited, reviewed and compiled financial statements and prepared tax returns. Mr. Graham’s experience serving as general counsel to publicly-held companies brings to our Board of Directors a comprehensive understanding of public company operations, financial reporting, disclosure and corporate governance, as well a perspective regarding potential acquisitions. With his accounting education and experience, he also brings a sophisticated understanding of accounting principles, auditing standards, internal accounting control and financial presentation and analysis.

Frederick Mills. Mr. Mills age 64, has served as a director of the company since August 2018 and has been a partner with the law firm Morrison & Mills, PA since 1989, a Tampa, Florida law firm that focuses on business law. Mr. Mills is also a founder and board member of Apex Labs, Inc. (toxicology lab in Tampa FL). Mr. Mills serves on numerous professional and civic boards. He received a B.S. from the University of Florida majoring in accounting and received a J.D. from the University of Florida. We believe that Mr. Mills will brings to the Board of Directors many years of valuable business and financial experience from his past experience as a founding board member and Audit Committee Chairman for Nature Coast Bank (OTCQB:NCBF), which was a publicly-held company, and his business law practice.

Frank Silcox. Mr. Silcox, age 58, has served as a director of the company since January 2021. Mr. Silcox has been a Managing Director of Osprey Capital since March 2015. From 2008 until 2015, Mr. Silcox was co-founder and a Managing member of LM Funding, LLC, a wholly-owned subsidiary of the company. Mr. Silcox has owned FS Ventures since 2003, which makes a variety of investments in real estate ventures. Mr. Silcox holds a Bachelor of Science from the University of Tampa.

Mr. Silcox brings considerable legal, financial and business experience to the Board of Directors. He has counseled and observed numerous businesses in a wide range of industries. The knowledge gained from his observations and his knowledge and experience in business transactions are considered important in monitoring the company’s performance and when we consider and pursue business acquisitions and financial transactions. His knowledge of other businesses and industries are useful in determining management and director compensation.

Directors Continuing in Office

Directors whose present terms continue until the next annual meeting of stockholders (Class I):

Bruce M. Rodgers. Mr. Rodgers, age 58, serves as the Chairman of the Board of Directors, Chief Executive Officer and President of the company. Prior to that, Mr. Rodgers owned Business Law Group, P.A. (“BLG”) and served as counsel to the founders of LM Funding, LLC, (“LMF”).the company’s predecessor and wholly-owned subsidiary. Mr. Rodgers was instrumental in developing the company’s business model prior to inception. Mr. Rodgers transferred his interest in BLG to other attorneys inwithin the firm by means of redemption of such interest in BLG prior to the company going public in 2015. Mr. Rodgers is also a member of the Board of Directors of SeaStar Medical Holding Corporation (Nasdaq: ICU), a medical technology company developing a platform therapy to reduce the consequences of hyperinflammation on vital organs. Mr. Rodgers is a former business transactions attorney and was an associate of Macfarlane, Ferguson, & McMullen, P.A. from 1991 to 1995 and a partner from 1995-1998 and was an equity partner of Foley & Lardner LLP from 1998 to 2003. Originally from Bowling Green, Kentucky, Mr. Rodgers holds an engineering degree from Vanderbilt University (1985) and a Juris Doctor, with honors, from the University of Florida (1991). Mr. Rodgers also served as an officer in the United States Navy from 1985-1989 rising to the rank of Lieutenant, Surface Warfare Officer. Mr. Rodgers is a member of the Florida Bar and holds an AV-Preeminent rating from Martindale Hubbell.

Mr. Rodgers brings to the Board of Directors considerable experience in business, management and law, and because of those experiences and his education, we believe that he possesses analytical and legal skills which are considered of importance to the operations of the company, the oversight of its performance and the evaluation of its future growth opportunities. Furthermore, his performance as chief executive officer has indicated an in-depth understanding of the company’s business. Mr. Rodgers and the Rodgers family hold a controlling majority interest in the Company.

Carollinn Gould. Ms. Gould, age 52,59, co-founded LMFLM Funding, LLC in January 2008, and hascurrently serves as a director of the company. From January 2008 to September 30, 2020, Mrs. Gould served as Vice President—General Manager, and a Director of the company since its initial public offering in October 2015.Secretary. Prior to joining LMF,LM Funding, LLC, Ms. Gould owned and operated a recruiting company specializing in the placement of financial services personnel. Prior to that, Ms. Gould worked at Outback Steakhouse (NYSE: OSI ) (“OSI”) where she opened the first restaurant in 1989 and finished her career at OSI in 2006 as shared services controller for over 1,000 restaurants. Ms. Gould holds a Bachelor’s Degree in Business Management from Nova Southeastern University.

As a co-founder of LMF,LM Funding, LLC, Ms. Gould brings to our Board of Directors an encyclopedia of knowledge regarding LMF’s growth, operations,the company’s business, operation, and procedures. Since inception, sheMs. Gould has controlled all bank accounts of the Companycompany and managed its internal control systems. SheMs. Gould also brings public company audit experience from her dutiesprior service as controller at OSI as well as a wealth of personnel management and human resources skills. Ms. Gould and the Rodgers family hold a controlling majority interest in the Company.

Directors Continuing in Office

Directors whose present terms continue until 2017the second annual meeting of stockholders following this Annual Meeting (Class II):

Douglas I. McCree. Mr. McCree, age 50,57, has served as a director of the company since its initial public offering in October 2015. Mr. McCree has been with First Housing Development Corporation of Florida (“First Housing”) since 2000 and has served as its Chief Executive Officer since 2004. From 1987 through 2000, Mr. McCree held various positions with Bank of America, N.A. including Senior Vice President—Affordable Housing Lending. Mr. McCree serves on numerous professional and civic boards. He received a B.S. from Vanderbilt University majoring in economics. Mr. McCree brings to the Board of Directors many years of banking experience and a strong perspective on public company operational requirements from his experience as Chief Executive Officer of First Housing.

Joel E. Rodgers, Sr.Tian “Todd” Zhang. Mr. Rodgers,Zhang, age 78,38, has served as a director of the company since its initial public offeringNovember 16, 2022. He has served in October 2015.a variety of corporate counsel roles where he has years of experience with matters involving securities, corporate governance, employee benefits, acquisitions, and compliance. On November 28, 2022, Mr. Rodgers has beenZhang will assume the role of Vice President, of Allied Signal, Inc. (1987-1992) and CEO of Baron Blakeslee, Inc. (1985-1987). Since 1995 Mr. Rodgers has served as a part-time Professor at Nova Southeastern University teaching finance, statistics, marketing, operations, and strategy. He has published numerous articles dealing with empowerment and corporate leadership. Mr. Rodgers represented the United States State Department in China, Mexico and Brazil in negotiations regarding the Montreal Protocol which dealt with limiting fluorocarbon discharge. Mr. Rodgers’ civic work extends to service on the library, hospital, and municipal utility boards of Bowling Green, Kentucky. Mr. Rodgers holds a Doctorate of Business Administration from Nova Southeastern University, a Masters of Business Administration from University of Kentucky, a B.S. in Mechanical Engineering from University of New Mexico and was a University of Illinois PhD candidate. He brings to our Board of Directors a lifetime of management, finance and marketing experience as well as an academic career of study in each.

Directors whose present terms continue until 2018 (Class III):

C. Birge Sigety. Mr. Sigety, age 62, has served as a director of the company since its initial public offering in October 2015. Mr. Sigety is currently CEO of Bison Investments,Associate General Counsel for Intertape Polymer Group, Inc., a private investment fund he started in 1996.global provider of packaging and protective solutions. Prior to that, Mr. Sigety was CEO of Professional Medical Products,Zhang served as Director, Senior Counsel and Assistant Secretary at Bloomin' Brands, Inc., a privately from September 2020 to November 18, 2022, as Director, Corporate Counsel at TECO Energy, Inc. from July 2018 through August 2020, and as an associate with the law firm DLA Piper LLP from April 2017 to June 2018. In these roles he prepared Section 16 filings, prepared materials for board and committee meetings, drafted corporate governance policies, assisted with secondary public offerings, and maintained ongoing compliance with certain credit facilities. Prior to his time with DLA Piper LLP, Mr. Zhang held company with over $165 million in sales, nine manufacturing plants, and 2200 employees doing business throughout the United States and in 40various other countries. Mr. Sigety has participated in a number of start-up companies in the banking, real estate, and medical device industries. Mr. Sigety holds a B.A. in English Literature from Bates College. Mr. Sigety brings to our Board of Directors an insight regarding all stages of development of companies and has experience growing companies from the start-up stage to international prominence. Mr. Sigety also brings to our Board of Directors a financial background incorporate attorney roles at public and private capital markets.

Martin A. Traber.companies. Mr. Traber, age 70, has served as a director of the company since its initial public offering in October 2015. Since 1994, Mr. Traber has been a partner of Foley & Lardner LLP, in Tampa, Florida, representing clients in securities law matters and corporate transactions. Mr. Traber is a founder of NorthStar Bank in Tampa, Florida and from 2007 to 2011 served as a member of the Board of Directors of that institution. Mr. Traber serves on the Board of Directors of JHS Capital Holdings, Tampa, Florida and on the Advisory Board of Platinum Bank, Tampa, Florida. From 2012 to 2013, he served on the Board of Directors of Exeter Trust Company, Portsmouth, New Hampshire. Mr. Traber holds a Bachelor of Arts and aZhang obtained his Juris Doctor from Indiana University.

Mr. Traber currently serves as a directorStetson University College of the board of directors of HCI Group, Inc., a New York Stock Exchange listed company headquarteredLaw in Tampa, Florida, primarily engaged in the homeowners’ insurance business (NYSE: HCI) (“HCI”) and as a member of HCI’s compensation committee and nominating and governance committee. Mr. Traber has served on the board of directors of HCI since its inception.

Mr. Traber brings considerable legal, financial and business experience to the Board of Directors. He has counseled and observed numerous businesses in a wide range of industries. The knowledge gained from his observations2011 and his knowledge and experience in business transactions and securities law are considered of importance in monitoring the Company’s performance and when we consider and pursue business acquisitions and financial transactions. As a corporate and securities lawyer, Mr. Traber has a fundamental understanding of governance principles and business ethics. His knowledge of other businesses and industries is useful in determining management and director compensation.

Andrew L. Graham. Mr. Graham, age 57, has served as a director of the company since its initial public offering in October 2015. Since June 2008, Mr. Graham has served as Vice President, General Counsel and Secretary of HCI Group, Inc. (NYSE:HCI). From 1999 to 2007, Mr. Graham served in various capacities, including as General Counsel, for Trinsic, Inc. (previously named Z-Tel Technologies, Inc.), a publicly-held provider of communications services headquartered in Tampa, Florida. Since 2011, Mr. Graham has served on the Internal Audit Committee of Hillsborough County, Florida. From 2007 to 2011, he served on the Board of Trustees of Hillsborough Community College, a state institution serving over 45,000 students annually. Mr. Graham holds a Bachelor of Science, major in Accounting, from Florida State University and a Juris Doctor, as well as a Master of Laws (L.L.M.) in Taxation,Bachelor’s Degree from the University of Florida College of Law.in 2007. Mr. Graham was licensed in Florida as a Certified Public Accountant from 1982 to 2001. As a Certified Public Accountant, he audited, reviewed and compiled financial statements and prepared tax returns. Mr. Graham’s experience serving as general counsel to publicly-held companiesZhang brings to ourthe Board of Directors a comprehensive understandingmany years of public company operations, financial reporting, disclosure,compliance and corporate governance experience, which we believe qualifies him to serve as well as perspective regarding potential acquisitions. With his accounting education and experience, he brings also a sophisticated understandingone of accounting principles, auditing standards, internal accounting control and financial presentation and analysis.our directors.

Arrangements as to Selection and Nomination of Directors

We are aware of no arrangements as to the selection and nomination of directors.

Independent Directors

Based upon recommendations of our nominating and governance committee, the Board of Directors has determined that current directorseach of Messrs. Graham, McCree, Graham, SigetyMills, Zhang, and TraberSilcox are “independent directors” meeting the independence tests set forth byin the rules of the NASDAQ Stock Market and Rule 10A-3(b)(i) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), including having no material relationship with the company (either directly or as a partner, shareholder or officer of an organization that has a relationship with the company).

Board Diversity

In August 2021, the caseSEC approved a Nasdaq proposal to adopt new listing rules related to board diversity and disclosure. The new Nasdaq listing rules require all Nasdaq listed companies to disclose consistent and transparent diversity statistics regarding their board of Mr. Traber,directors. The rules also require most Nasdaq listed companies to have, or explain why they do not have, at least two diverse directors, including one who self-identifies as female and one who self-identifies as either an under-represented minority or LGBTQ+. As seen in the Board Diversity Matrix below, the company would be in compliance with Nasdaq’s diversity requirement.

The composition of our Board of Directors considered his role as a partnerreflects diversity of Foley & Lardner LLP, which provides legal services togender, race and ethnicity. Specifically, our Board of Directors has one woman, Ms. Gould, and 1 ethnically diverse director, Mr. Zhang. We believe the company,two directors mentioned above are “diverse” under Nasdaq rules, and determined that we satisfy the fees received bydiversity requirements under the law firm from us amount to less than 1%Nasdaq rules. Our Board of Directors diversity matrix for the firm’s total revenue and also considered Mr. Traber’s personal financial substance, his other sources of income and his lack of dependence upon legal fees from the company.current year is below.

Board Diversity Matrix (as of November 23, 2022) | ||||

Total Number of Directors |

|

| 7 |

|

|

| Female |

| Male |

Part I: Gender Identity |

| 1 |

| 6 |

Part II: Demographic Background |

|

|

|

|

White |

| 1 |

| 5 |

Asian |

| - |

| 1 |

DIRECTOR COMPENSATION

The compensation of our non-employee directors is determined by the Board of Directors, which solicits a recommendation from the compensation committee.

Directors who are employees of the company do not receive any additional compensation for their service as directors. During 2015, the company’s non-employee directors each earned fees of $2,917 for service to the company, which includes attendance at Board and committee meetings held during 2015.

The following table sets forth information with respect to compensation earned by each of our directors (other than “named executive officers”) during the year ended December 31, 2015.

|

| Fees |

|

|

|

|

|

|

|

|

| |

|

| Earned or |

|

|

|

|

|

|

|

|

| |

|

| Paid in |

|

| Option |

|

|

|

|

| ||

|

| Cash |

|

| Awards |

|

|

|

|

| ||

Name |

| ($)(1) |

|

| ($) |

|

| Total ($) |

| |||

Martin A. Traber |

| $ | (2 | ) |

| $ | — |

|

| $ | — |

|

Andrew Graham |

| $ | 2,917 |

|

| $ | — |

|

| $ | 2,917 |

|

C. Birge Sigety |

| $ | 2,917 |

|

| $ | — |

|

| $ | 2,917 |

|

Douglas I. McCree |

| $ | 2,917 |

|

| $ | — |

|

| $ | 2,917 |

|

Joel E. Rodgers, Sr. |

| $ | 2,917 |

|

| $ | — |

|

| $ | 2,917 |

|

|

|

|

|

TRANSACTIONS WITH RELATED PERSONS

Transactions

LMF has engaged Business Law Group, P.A., (“BLG”) on behalf of many of its Association clients to service and collect the Accounts and to distribute the proceeds as required by Florida law and the provisions of the purchase agreements between LMF and the Associations. In addition, Ms. Gould entered into an employment agreement to work part-time with the LMF. Ms. Gould’s employment agreement with LMF permits her to also work as General Manager of Business Law Group, P.A. which pays her additional compensation of $150,000 per year.

Legal Services

One of our directors, Martin A. Traber, is a partner at the law firm of Foley & Lardner LLP, and since our inception in 2015, the firm has provided legal representation to us. During 2015, Foley & Lardner LLP billed us approximately $699,000, which represents less than 1% of Foley & Lardner’s fee revenue. These services were provided on an arm’s-length basis, and paid for at fair market value. We believe that such services were performed on terms at least as favorable to us as those that would have been realized in transactions with unaffiliated entities or individuals. These billings include the legal fees incurred in filing our S-1 registration statement and subsequent IPO.

ADVERSE INTERESTS

We are not aware of any material proceedings in which an executive officer or director is a party adverse to the company or has a material interest adverse to the company.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Based solely upon a review of Forms 3, 4, and 5 filed for the year 2015, we believe that all of our directors, officers, and 10% beneficial owners complied with all Section 16(a) filing requirements applicable to them. In addition, all such forms were filed timely.

We have adopted a code of ethics applicable to all employees and directors, including our chief executive officer and chief financial officer. We have posted the text of our code of ethics to our internet web site: www.lmfunding.com by clicking “Investors” at the top and then “Corporate Governance” and then the appropriate “Code of Ethics”. We intend to disclose any change to or waiver from our code of ethics by posting such change or waiver to our internet web site within the same section as described above.

CORPORATE GOVERNANCE GUIDELINES

We have adopted Corporate Governance Guidelines to promote effective governance of the company. A current copy of our Corporate Governance Guidelines is available on our website www.lmfunding.com by clicking “Investors” at the top and then “Corporate Governance” and then “Corporate Governance Guidelines.”

MEETINGS OF THE BOARD OF DIRECTORS

The Board of Directors held one meeting during 2015. During 2015, no director attended less than 75% of the Board and applicable committee meetings.

Board members are encouraged, but not required to attend the Annual Meeting of the Shareholders.

COMMUNICATIONS WITH THE BOARD OF DIRECTORS

We have established procedures by which shareholders may communicate with members ofSeptember 2020, the Board of Directors, individually or asbased on the recommendation of the compensation committee, approved a group. Shareholders wishingspecial payment for each outside director to communicate withcompensate its outside directors for the company’s non-payment of certain compensation since 2015. Such special payment was approved in the amount of $15,000 for each outside director for each year from 2017 to 2020 for which no payment was made to the outside directors. This payment was made in October 2020.

On October 27, 2021, the Board of Directors oradopted and approved a specified membernon-employee director compensation program (the “Non-Employee Director Compensation Program”) that provides for annual retainer fees and equity awards for our non-employee directors. The program was adopted under the 2021 Omnibus Incentive Plan. Under the Non-Employee Director Compensation Program, each non-employee director of the Board may send written communications addressed to: Boardcompany receives an annual cash retainer of Directors, LM Funding America, Inc., c/o Aaron Gordon, Esq., General Counsel and Secretary of the Corporation, 302 Knights Run Avenue, Suite 1000, Tampa, Florida 33602. The mailing envelope should clearly specify the intended recipient or recipients, which may be the Board of Directors as$60,000 (or $90,000 for audit committee members) payable in arrears in equal quarterly payments, pro-rated for partial years. Non-employee directors will also receive an annual stock option award to purchase a group or an individual member of the Board. The communication should include the shareholder’s name and the number of shares owned. Communications that are not racially, ethically or religiously offensive, commercial, pornographic, obscene, vulgar, profane, defamatory, abusive, harassing, threatening, malicious, false or frivolous in natureequal to $60,000 (or $90,000 for audit committee members) divided by the option exercise price (which will be promptly forwardedequal to the specified membersfair market value of the Boardcompany’s common stock on the date of Directors. We have also established procedures bygrant), which all interested parties (not just shareholders) may communicate directly with our non-management or independent directors as a group. Any interested party wishing to communicate with our non-management or independent directors as a group may send written communications addressed to: Board of Directors, LM Funding America, Inc., c/o Aaron Gordon, Esq., General Counselannual awards will vest one-half on the 180th day after the grant date and Secretaryone-half on the first anniversary of the Corporation, 302 Knights Run Avenue, Suite 1000, Tampa, Florida 33602.grant date. The mailing envelope should clearly specifyannual option award will be granted on the intended recipients,day of the company’s annual stockholder meeting each year. The Non-Employee Director Compensation Program also provides for an initial option grant on the date on which may bea person first becomes a director of the non-managementcompany with respect to a number of shares equal to $25,000 divided by the exercise price, and it provides for the grant of an option on October 28, 2021 to each non-employee director then serving on the board of directors orto purchase a number of shares equal to $60,000 ($75,000 for audit committee members) divided by the independent directors asexercise price, which was $5.95 per share. Options granted under the Non-Employee Director Compensation Program are subject to accelerated vesting upon a group. The Secretary will promptly forwardchange of control of the envelopecompany (as defined in the 2021 Omnibus Plan), and the options granted on October 28, 2021 are subject to accelerated vesting in the event that the closing price of the company’s common stock exceeds $12.00 for distributionten consecutive trading days.

On November 18, 2022, the Board approved certain amendments to the intended recipients.

COMMITTEES OF THE BOARD OF DIRECTORS

The Boardcompany’s Non-Employee Director Compensation Program (the “Amended Program”). Pursuant to the Amended Program, each non-employee director of Directors hasthe company will receive an annual cash retainer of $66,000 (or $99,000 for audit committee members) payable in arrears in equal quarterly payments, pro-rated for partial years. Non-employee directors will also receive an annual stock option award to purchase a compensation committee, and a nominating and governance committee.

Audit Committee

The company has a separately-designated standingnumber of shares equal to $66,000 (or $99,000 for audit committee established in accordance withmembers) divided by the Securities and Exchange Act of 1934. The audit committee’s responsibilities includeoption exercise price (which will be equal to the following:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The audit committee is composed of three members: Andrew Graham, its chairman, C. Birge Sigety and Douglas I. McCree. Since our common shares are listed on Nasdaq Capital Markets, we are governed by its listing standards. Accordingly, the membersfair market value of the audit committee are considered to be “independent directors” pursuant tocompany’s common stock on the definition contained in Rule 5605(a)(2)date of grant), which annual awards will vest one-half on the 180th day after the grant date and one-half on the first anniversary of the NASDAQ andgrant date. The annual option award will be granted on the criteria for independence set forth in Rule 10A-3(b)(1)day of the Securities and Exchange Commission. The Board of Directors has determined that Mr. Graham is an audit committee financial expert. The Audit Committee met formally one time during 2015 and otherwise acted by unanimous written consent. The Board of Directors has adopted a written Audit Committee Charter. A current copy of the charter is available on our website www.lmfunding.com by clicking “Investors” and then “Corporate Governance.”

Compensation Committee

The compensation committee’s responsibilities include the following:

|

|

|

|

|

|

|

|

|

|

|

|

The compensation committee has the authority to determine the compensation of the named executive officers, except the Chief Executive Officer. The compensation committee makes recommendationscompany’s annual stockholder meeting each year. Upon initial election or appointment to the Board of Directors for(or on such later date as is determined by the Board of Directors), non-employee directors and Chief Executive Officer compensation and equity awardswill also automatically receive stock options to purchase shares under the company’s 2015 Omnibus Incentive Plan. At least annuallyequity incentive plan equal to $25,000 divided by the compensation committee considersexercise price of the resultsoption, with such exercise price being equal to the grant date fair value of the company’s operations and its financial position and makes compensation determinations. common stock.

The compensation committee did not engage or rely on consultants in determiningtable below summarizes the compensation paid to executive officers in 2015, instead relying on the judgment and knowledge of its own members. The compensation committee views the determination of such compensation to be a collaborative effort and accordingly it welcomes recommendations and advice from executive officers and other directors. The compensation committee is composed of three members: C. Birge Sigety, Douglas I. McCree and Martin A. Traber each of whom have been determined to be “independent” within the meaning of SEC and NASDAQ regulations. The Board of Directors has adopted a formal compensation committee charter. As required under NASDAQ Rule 5605(d)(1), the Compensation Committee assesses the adequacy of its charter on an annual basis. The compensation committee met formally one time during 2015 and otherwise acted by unanimous written consent.

A current copy of the charter is available on our website www.lmfunding.com by clicking “Investors” and then “Corporate Governance.”

Nominating and Governance Committee

The functions of the nominating and governance committee include the following:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The nominating and governance committee is composed of three members: Douglas I. McCree, Bruce M. Rodgers and Joel E. Rodgers, Sr. The nominating and governance committee did not meet in 2015, but held a meeting in 2016 prior to the submission of this proxy statement. The Board of Directors has adopted a written nominating and governance committee charter. A current copy of the charter is available on our website at www.lmfunding.com by clicking “Investors” and then “Corporate Governance.”

Each of the proposed director nominees was recommended by the nominating and governance committeecompany to non-employee directors or earned by the Board of Directors.

The nominating and governance committee identifies director candidates in numerous ways. Generally, the candidates are known to and recommended by members of the Board of Directors or management. In evaluating director candidates, the nominating and governance committee considers a variety of attributes, criteria and factors, including experience, skills, expertise, diversity, personal and professional integrity, character, temperament, business judgment, time availability, dedication and conflicts of interest. At a minimum, director candidates must be at least 18 years of age and have such business, financial, technological or legal experience or education to enable them to make informed decisions on behalf of the company. The nominating and governance committee has not adopted a specific policy on diversity.

The nominating and governance committee will consider director candidates recommended by shareholders. Any shareholder wishing to recommend one or more director candidates should send the recommendations before November 1st of the year preceding the next annual meeting of shareholders to the Secretary of the company, Aaron Gordon, Esq., General Counsel and Secretary, 302 Knights Run Avenue, Suite 1000, Tampa, Florida 33602. Each recommendation should set forth the candidate’s name, age, business address, business telephone number, residence address, and principal occupation or employment and any other attributes or factors the shareholder wishes the committee to consider, as well as the shareholder’s name, address and telephone number and the class and number of shares held. The Committee may require the recommended candidate to furnish additional information. The secretary will forward recommendations of qualified candidates to the nominating and governance committee and those candidates will be given the same consideration as all other candidates.

A shareholder wishing to nominate an individual for election to the Board of Directors at the Annual Meeting of the Shareholders, rather than recommend a candidate to the Nominating and Governance Committee, must comply with the advance notice requirements set forth in our bylaws. See “Shareholder Proposals for Presentation at the 2017 Annual Meeting” for further information.

Board of Directors Leadership Structure

Our business and affairs are managed under the direction of the Board of Directors. Under our current leadership structure, Bruce M. Rodgers serves as chairman of the board and chief executive officer. Mr. Rodgers’ role includes providing continuous feedback on the direction and performance of the company, serving as chairman of regular meetings of the Board of Directors, setting the agenda of meetings of the Board of Directors and leading the Board of Directors in anticipating and responding to changes in our business. Mr. Rodgers plays a significant role also in formulating and executing the company’s strategic plans, financing activity and investment decisions. We believe board oversight and planning is a collaborative effort among thenon-employee directors each of whom has unique skills, experience and education, and this structure facilitates collaboration and communication among the directors and management and makes the best use of their respective skills. The Board of Directors periodically reviews the board leadership structure to evaluate whether the structure remains appropriate for the company and may determine to alter this leadership structure anytime based on then existing circumstances.

Board of Directors’ Role in Risk Oversight

The Board of Directors plays a significant role in monitoring risks to the company. Where major risks are involved, the Board of Directors takes a direct role in reviewing those matters. The Board of Directors also approves any strategic initiatives and any large or unusual investment or other such expenditure of the company’s resources. The Board of Directors has established committees to assist in ensuring that material risks are identified and managed appropriately. Among them are the audit committee, the compensation committee, and the nominating and governance committee. The Board and its committees regularly review material operational, financial, compensation and compliance risks with executive management. The audit committee is responsible for assisting the Board of Directors in its oversight of the quality and integrity of our accounting, auditing, and reporting practices and discussing with management our processes to manage business and financial risk. The compensation committee considers risk in connection with its design of our compensation programs for our executives. The nominating and governance committee regularly reviews the company’s corporate governance structure and board committee assignments. Each committee regularly reports to the Board of Directors.

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Skoda Minotti & Co. Certified Public Accountants was our principal registered public accounting firm for 2015.

AUDIT FEES

The following table sets forth the aggregate fees for services related to the years ended December 31, 2015 and 2014 provided by Skoda Minotti & Co. Certified Public Accountants, our principal accountant:

|

| 2015 |

|

| 2014 |

| ||

Audit Fees(1) |

| $ | 187,000 |

|

| $ | 105,000 |

|

All Other Fees(2) |

|

| 191,050 |

|

|

| 10,650 |

|

Total |

| $ | 378,050 |

|

| $ | 115,650 |

|

|

|

|

|

PRE-APPROVAL POLICIES

All auditing services and non-auditing services are pre-approved by the audit committee. The audit committee has delegated this authority to the chairman of the audit committee for situations when pre-approval by the full audit committee is inconvenient. Any decisions by the chairman of the audit committee must be disclosed at the next audit committee meeting.

AUDIT COMMITTEE REPORT

TO: The Board of Directors of LM Funding America, Inc.

The audit committee oversees the financial reporting processes of LM Funding America, Inc. on behalf of the Board of Directors. Management has the primary responsibility for the financial statements and the reporting process, including the systems of internal controls. In fulfilling its oversight responsibilities, the audit committee reviewed the audited financial statements in the Annual Report with management and discussed with management the quality, in addition to the acceptability, of the accounting principles, the reasonableness of significant judgments, and the clarity of disclosures in the financial statements.

The audit committee reviewed with representatives of Skoda Minotti & Co. Certified Public Accountants, the company’s independent registered public accounting firm responsible for auditing the company’s financial statements and expressing an opinion on the conformity of those audited financial statements with accounting principles generally accepted in the United States of America, their judgments as to the quality, not just the acceptability, of the company’s accounting principles. The audit committee has discussed with the independent registered public accounting firm the matters required to be discussed under auditing standards adopted by the Public Company Accounting Oversight Board. The audit committee has received the written disclosures and the letter from the independent registered public accounting firm required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent accountant’s communications with the audit committee concerning independence, and has discussed with the independent accountant the independent accountant’s independence.

The audit committee discussed with representatives of Skoda Minotti & Co. Certified Public Accountants, the overall scope and plans for their audit. The audit committee met with representatives of Skoda Minotti & Co. Certified Public Accountants, with and without management present, to discuss the results of their examinations, their evaluations of the company’s internal controls, and the overall quality of the company’s financial reporting.

In reliance on the reviews and discussions referred to above, the audit committee recommended to the Board of Directors the inclusion of the audited financial statements in the company’s Annual Report on Form 10-K for thefiscal year ended December 31, 2015 for filing with the Securities2020 and Exchange Commission.

AUDIT COMMITTEE

Andrew Graham, Chairman

C. Birge Sigety

Douglas I. McCree2021.

|

|

|

Fees |

|

|

|

|

|

|

|

|

| |

|

|

| Earned or |

|

|

|

|

|

|

|

|

| |

|

|

| Paid in |

|

| Option |

|

|

|

|

| ||

|

|

| Cash |

|

| Awards |

|

|

|

|

| ||

Name (1) (2) | Year |

| ($)(1) |

|

| ($) |

|

| Total ($) |

| |||

Carollinn Gould (3) | 2021 |

| $ | 25,000 |

|

| $ | 54,756 |

|

| $ | 79,756 |

|

| 2020 |

| $ | — |

|

| $ | — |

|

| $ | — |

|

Andrew Graham | 2021 |

| $ | 25,000 |

|

| $ | 68,445 |

|

| $ | 93,445 |

|

| 2020 |

| $ | 60,000 | 6) |

| $ | — |

|

| $ | 60,000 |

|

Frederick Mills | 2021 |

| $ | 25,000 |

|

| $ | 68,445 |

|

| $ | 93,445 |

|

| 2020 |

| $ | 45,000 | (6) |

| $ | — |

|

| $ | 45,000 |

|

Douglas I. McCree | 2021 |

| $ | 25,000 |

|

| $ | 68,445 |

|

| $ | 93,445 |

|

| 2020 |

| $ | 60,000 | 6) |

| $ | — |

|

| $ | 60,000 |

|

Martin A. Traber (4) | 2021 |

| $ | - |

|

| $ | — |

|

| $ | - |

|

| 2020 |

| $ | 60,000 | (6) |

| $ | — |

|

| $ | 60,000 |

|

Frank Silcox | 2021 |

| $ | 25,000 |

|

| $ | 54,756 |

|

| $ | 79,756 |

|

| 2020 |

| $ | — |

|

| $ | — |

|

| $ | — |

|

Joel E. Rodgers, Sr. (5) | 2021 |

| $ | 25,000 |

|

| $ | 54,756 |

|

| $ | 79,756 |

|

| 2020 |

| $ | 60,000 | (6) |

| $ | — |

|

| $ | 60,000 |

|

(1) Bruce Rodgers, our chairman and chief executive officer, is not included in this table because he was an employee in 2020 and 2021 and thus received no compensation for his services as director. The compensation received by Mr. Rodgers is set forth in the Summary Compensation Table below.

(2) Tian Zhang was appointed as a director on November 16, 2022. Accordingly, he did not receive any compensation during 2020 or 2021.

(3) Carollinn Gould was employed by the company as its Vice President—General Manager and Secretary until September 30, 2020. Ms. Gould served as an executive officer of the company, but not a named executive officer, who did not receive any additional compensation for services provided as a director for the company’s fiscal year ended December 31, 2020. The compensation received by Ms. Gould as an employee of the company is set forth in the section below entitled “Transactions With Related Persons.”

(4) Mr. Traber ceased to be a director of our company in January 2021.

(5) Mr. Joel E. Rodgers ceased to be a director of our company in November 2022.

(6) Represents fees paid in October 2020 for the period from January 1, 2017 through December 31, 2020, $15,000 of which is attributable to the period from January 1, 2020 through December 31, 2020.

EXECUTIVE OFFICERS

The following table provides information with respect to our executive officers as of April 29, 2016:November 17, 2022:

Name |

| Age |

| Title |

Bruce M. Rodgers |

|

|

| Chairman, |

|

|

|

| Chief Financial Officer |

|

|

|

| Vice President of Operations |

|

|

|

|

|

|

|

|

Bruce M. Rodgers. Mr. Rodgers background and experience is contained above in the section of thethis Proxy Statement entitled “Directors” above.“Directors.”

Stephen Weclew.Richard RussellMr. Weclew,Russell, age 36,61, has served as Chief Financial Officer of the company since its initial public offering in October 2015, in charge of allNovember 2017. Since 2016, he has provided financial reporting. From 2012and accounting consulting services with a focus on technical and external reporting, internal auditing, mergers & acquisitions, risk management, and CFO and controller services. Mr. Russell also served as Chief Financial Officer for Mission Health Communities from 2013 to 2014,2016 and, before that, Mr. WeclewRussell served in various finance positionsa variety of roles for the North American Wound Care Division of Smith and NephewCott Corporation from 2007 to 2013, including Senior Director of Finance, Finance Manager,Senior Director of Internal Auditing, and Reporting/Assistant Corporate Controller. Mr. Russell’s extensive professional experience with public companies includes his position as Director of Financial Reporting and Internal Controls Manager. From 2010for Quality Distribution a previously listed publicly held company traded on the Nasdaq Stock Exchange (“QLTY”) and as Danka’s Director of Reporting from 2001 to 2012, 2004 a previously listed publicly held office imaging company traded on both the London Stock Exchange and the Nasdaq Stock Exchange (“DANKY”). Mr. Weclew wasRussell also serves as Chief Financial Officer and as a director of SeaStar Medical Holding Corporation (Nasdaq: ICU), a medical technology company developing a platform therapy to reduce the Assistant Controller for Airgas Retail Solutions,consequences of hyperinflammation on vital organs. Mr. Russell also previously served on a part-time basis as Chief Financial Officer of Generation Income properties Inc. (“GIPR”), which is a publicly traded real estate company traded on the Nasdaq market, from December 2019 to

February 2022. Mr. Weclew was a Senior Business Consultant with BST Global, Inc. from 2007 to 2010 and servedRussell earned his Bachelor of Science in the Audit and Assurance practice for Deloitte & Touche from 2004 to 2007. Mr. Weclew earned a B.S. in Business, Major Accountingaccounting and a Masters of AccountancyMaster’s in tax accounting from the University of Central Florida.Alabama, a Bachelor of Arts in international studies from the University of South Florida, and a Master’s in business administration from the University of Tampa. On March 1, 2020, Mr. Russell was appointed to the board of directors for Trident Brands Inc. (“TDNT”), a publicly held consumer products company traded on the OTCQB market. Mr. Russell was also Chairman of the Hillsborough County Internal Audit Committee and had been a member of the Committee from September 2016 to April 2021. He is a licensed C.P.A.was reappointed to the Committee in October 2021.

Sean Galaris.Ryan Duran. Mr. Galaris,Duran, age 47, has served38, currently serves as Vice President of Operations of the company since its initial public offeringand joined the company in OctoberMarch 2015. Prior to joining the company, Mr. GalarisDuran served as Senior Vice PresidentOperations Manager of The ContinentalBusiness Law Group, a FirstService Corporation held company (NASDAQ: FSRV), and President of its subsidiary Sterling Management for 13 years. Operating in the largest geographic region in Florida,since 2008. Mr. Galaris was responsible for managing approximately 350 properties across North Florida. Working with national and local developers to build several of the largest communities in Florida, Mr. Galaris managed the openings of over 100 condominium and homeowner associations across the state. He has been a licensed Real Estate Broker and Community Association Manager for over 15 years. Originally from the greater Boston area, heDuran holds a B.S.bachelor’s degree in Business (Management) from Salem State College where he captained the men’s basketball team for three years, prior to his career as a professional basketball player in Europe.

Carollinn Gould. Ms. Gould’s background and experience is contained above in the section of the Proxy Statement entitled “Directors” above.

Aaron Gordon. Mr. Gordon, age 30, has served as General Counsel and Secretary of the company since its initial public offering in October 2015. Mr. Gordon supervises the acquisition of delinquent condominium and home owner’s association accounts receivable. Since 2009, Mr. Gordon has provided legal counsel for LMF’s business operations. Prior to his career as a lawyer Mr. Gordon was an associate for HealthTrust, LLC, a commercial real estate valuation firm which specializes in the seniors’ housing sector. Originally from Fort Myers, Florida, Mr. Gordon holds a B.S. in Real Estateand finance from Florida State University, Magna Cum Laude, and a Juris Doctor from the University of Florida with a practice certificate in Estates and Trust Administration. Mr. Gordon was admitted to the Florida Bar in 2009 and the New York Bar in 2010.University.

We are aware of no arrangements as to the selection or appointment of executive officers.

EXECUTIVE COMPENSATION AND RELATED INFORMATION

SUMMARY COMPENSATION TABLE

The following table provides summary information concerning compensation for services rendered in all capacities awarded to, earned by or paid to our named executive officers during the years ended December 31, 20152021 and 2014. The table does not include compensation2020.

|

|

|

|

|

|

|

| Stock |

| Option |

| All Other |

|

|

| ||||||

|

| Fiscal |

| Salary |

| Bonus |

| Awards |

| Awards |

| Compensation |

| Total | |||||||

Name and Principal Position |

| Year |

| ($) |

| ($) |

| ($) (1) |

| ($) (1) |

| ($)(2) |

| ($) | |||||||

Bruce Rodgers |

| 2021 |

| $ | 330,812 |

| $ | 1,140,000 |

| $ | 144,375 |

| $ | 9,690,500 |

| $ | 9,506 |

| 11,315,193 |

| |

Chairman, CEO and President |

| 2020 |

|

| 362,500 |

| $ | 854,000 |

| $ | — |

|

| — |

|

| 8,757 |

| 1,225,257 |

| |

Richard Russell |

| 2021 |

|

| 193,090 |

|

| 1,140,000 |

|

| 75,000 |

|

| 9,690,500 |

|

| 27,298 |

| 11,127,888 |

| |

Chief Financial Officer |

| 2020 |

|

| 188,322 |

|

| 595,000 |

|

| — |

|

| — |

|

| 27,112 |

| 810,434 |

| |

Ryan Duran |

| 2021 |

|

| 154,808 |

|

| 25,000 |

|

| — |

|

| 847,919 |

|

| 29,298 |

| 1,057,025 |

| |

Vice President of Operations |

| 2020 |

|

| 155,769 |

|

| 20,000 |

|

| — |

|

| — |

|

| 26,618 |

| 202,387 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Stock |

|

| Option |

|

| All Other |

|

|

|

|

| |||

|

| Fiscal |

|

| Salary |

|

| Bonus |

|

| Awards |

|

| Awards |

|

| Compensation |

|

| Total |

| |||||||

Name and Principal Position |

| Year |

|

| ($) |

|

| ($) |

|

| ($)(1) |

|

| ($) |

|

| ($)(3) |

|

| ($) |

| |||||||

Bruce Rodgers |

|

| 2015 |

|

| $ | 62,192 |

|

| $ | — |

|

| $ | — |

|

| $ | — |

|

| $ | 666 |

|

| $ | 62,858 |

|

Chairman and CEO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stephen Weclew |

|

| 2015 |

|

| $ | 116,000 |

|

| $ | — |

|

| $ | — |

|

| $ | — |

|

| $ | 16,051 |

|

| $ | 132,051 |

|

Chief Financial Officer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sean Galaris |

|

| 2015 |

|

| $ | 166,154 |

|

| $ | — |

|

| $ | — |

|

| $ | 223,020 |

| (2) | $ | 22,224 |

|

| $ | 397,378 |

|

President |

|

| 2014 |

|

| $ | 150,000 |

|

| $ | 81,427 |

|

| $ | — |

|

| $ | — |

|

| $ | 17,451 |

|

| $ | 248,878 |

|

|

|

|

These amounts consist of |

|

|

- health insurance premiums paid by the company in excess of non-executive contribution

- Auto Allowance

|

|

|

|

|

| Health |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

| Insurance |

|

| Auto |

|

|

|

|

| ||

|

|

|

|

|

| Premiums |

|

| Allowance |

|

|

|

|

| ||

Name |

| Year |

|

| ($) |

|

| ($) |

|

| Total ($) |

| ||||

Bruce Rodgers |

|

| 2015 |

|

| $ | 666 |

|

| $ | — |

|

| $ | 666.00 |

|

Stephen Weclew |

|

| 2015 |

|

| $ | 16,051 |

|

| $ | — |

|

| $ | 16,051.00 |

|

Sean Galaris |

|

| 2015 |

|

| $ | 20,224 |

|

| $ | 2,000 |

|

| $ | 22,224.00 |

|

|

|

| 2014 |

|

| $ | 17,451 |

|

| $ | — |

|

| $ | 17,451.00 |

|

Certain executives’ compensation and other arrangements are set forth in employment agreements. These employment agreements are described below.

Bruce M. Rodgers.

In October 2021, Mr. Rodgers’ entered into an amended and restated employment agreement with the company (the “Restated Rodgers Agreement”) which provides for an annual base salary of $750,000. The Restated Rodgers Agreement provided for a grant of 48,662 shares of the company’s common stock that were paid in February 2022, with an amount of shares equal to the taxes payable by Mr. Rodgers with respect to the grant having been withheld to satisfy such taxes. The Restated Rodgers Agreement originally provided for certain bonuses upon a change of control of the company (as defined in the Restated Rodgers Agreement), but as stated below, such change-of-control provisions were eliminated in November 2022. Pursuant to the Restated Rodgers Agreement, Mr. Rodgers was also originally entitled to receive his applicable base salary for a period of 36 months after termination if such termination were “without cause” or if he terminated his own employment for a “good reason event,” as those terms are defined in the Restated Rodgers Agreement, in addition to any accrued bonus as of the termination date and the accelerated vesting of any unvested options. However, such severance provisions were eliminated and replaced in November 2022, as described below. The Restated Rodgers Agreement also contains certain non-competition covenants and confidentiality provisions.